Tds payment type challan codes tax income importance Greytrix tds quarterly return update september challan required statements file validating regular Challan paying jagoinvestor reciept

How to pay Income Tax through Challan 280

How to generate a new tds challan for payment of interest and late Challan for paying tax on interest income Tds challan download (missing) from income tax portal

Axis tds challan

Tds challan 281 excel formatIncome tax e-filing portal : view tds form Challan payment cleartaxChallan tds deposit vary subject.

How to pay tds challan by income tax portalHow to download tds challan and make online payment Income tax challan status: how to check tds challan status?Tds filed quicko.

Challan tax counterfoil income payment online taxpayer quicko learn assessment self

Tds challan format excel chequeGreytrix tds – quarterly e-tds return september update Challan tds tax itns payment online pay tax2win date serial deposit cheque collecting cash bsr amount optional tender branch codeTds challan procedure return paying after computation update details these our.

301 moved permanentlyChallan tds interest penalty lesson create tally erp9 printout done its get How to generate a new tds challan for payment of interest and lateWhat are the steps to paying tds on property purchase?.

How to download tds challan and make online payment

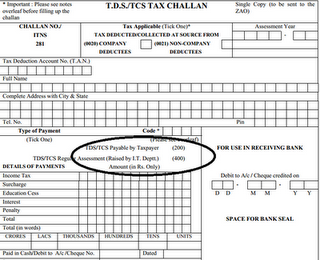

T.d.s./tcs tax challanChallan tds tcs Challan tds tax payment 280 online 281 bank number throughTds challan 280, 281 for online tds payment.

Income tax challan 281 in excel formatLaw and procedure of tds payment challan and returns under 194m Challan 194m procedure tds lawTds challan nov 15.

Tds challan 281

How to download tds challan and make online paymentTds online payment, income tax challan 281 online, traces login at Procedure after paying challan in tdsLesson-47 how to create tds interest/penalty challan in tally.erp9.

Tds challan 281 excel format fill out and sign printaTds e-payment, challan, sections, certificates etc., Tds payment process online on tin-nsdlTds challan 281 excel format 2020-2024.

Tds payment challan excel format tds challana excel format

Axis tds challan form pdfChallan tds 281 tcs itns Challan tds chequeHow to pay income tax through challan 280.

Importance of "type of payment codes" in tds or income tax challanTds challan status enquiry via online tax accounting system E-tds return file| how to download tds challan (csi) from income taxTds/tcs tax challan no./itns 281.

TDS Online Payment, Income Tax Challan 281 Online, TRACES Login at

How to pay Income Tax through Challan 280

How To Download TDS Challan and Make Online Payment - Tax2win

+E+-+PAYMENT+OR+ONLINE+PAYMENT+1+.jpg)

301 Moved Permanently

E - PAYMENT OR ONLINE PAYMENT 2.jpg)

Income Tax Challan 281 In Excel Format

Greytrix TDS – Quarterly E-TDS Return September Update - Sage 300 ERP

TDS Challan 280, 281 for Online TDS Payment